EOS Magazine

Annual and Sustainability Report 2024/25

In our Annual and Sustainability Report, we reflect on a successful financial year in which we courageously tackled new challenges. The report outlines the EOS Group’s principal activities and business highlights, along with its strategies for corporate, social, and environmental responsibility.

Press releases

EOS Group, IFC Partner to Resolve Non-Performing Loans, Boost Lending in Poland

Hamburg, March 14, 2024

- New €275 million facility to purchase and resolve NPLs in Poland

- Project will build resilience of banking sector and foster new lending

- Strong focus on environmental, social and governance aspects

A new €275-million platform in Poland will help financial institutions resolve their non-performing loans (NPLs), freeing up capital for new lending, allowing individuals and businesses to restore their creditworthiness, and bolstering the country’s banking sector.

Co-funded by IFC and EOS Group (EOS), the new facility focuses on the acquisition and resolution of non-performing loans of retail clients, small and medium enterprises, and real estate-owned assets (REOs) held by financial institutions in Poland. The new facility incorporates environmental and social standards into its NPL resolution practices, in line with IFC's Performance Standards. These include objectives such as preventing environmental damage when working with real estate, ensuring borrowers are treated fairly and responsibly.

"Together with our partner IFC, we are delighted to be able to expand our cooperation in the important NPL market in Poland and thus strengthen our activities as a sustainable investor," said Carsten Tidow, Managing Director of the EOS Group and responsible for Eastern Europe. "As one of the largest and most active NPL markets in Eastern Europe, Poland is a particular focus for EOS. In addition to the positive contribution to the Polish economy, the consideration of environmental, social and governance aspects continues to play a major role in the selection and resolution of NPLs."

The new facility is part of IFC’s Distressed Asset Recovery Program (DARP), which focuses on the acquisition and resolution of distressed assets across emerging markets. The $9.1 billion global investment program includes commitments of $3.2 billion on IFC’s account and $5.9 billion mobilized from private sector investors.

The project will be the third engagement of IFC and EOS, following the creation of a facility in 2010 to purchase and resolve unsecured retail NPL portfolios, and a €129 million regional facility to help financial institutions resolve their NPLs in Bosnia and Herzegovina, Croatia, Romania, and Serbia in 2022.

"IFC is a market leader in distressed asset acquisition and resolution in emerging markets,” said Ariane di Iorio, Global Head of Distressed Assets Investments at IFC. “By supporting distressed assets markets in our target countries sustainably and ethically, we help financial institutions return to their core lending businesses and normalize NPLs so borrowers can become creditworthy again.”

“Ethical debt collection has always been at the core of our business, thus integrating sustainable investment into our processes is a natural next step,” said Dariusz Petynka, Managing Director of EOS Poland. EOS has been active in the NPL market in Poland for over 25 years. “Over the past few years, we have been fortunate to make very significant investments in NPL portfolios in Poland. The cooperation with IFC will allow us to strengthen our position as one of the leading players in the Polish market,” said Borys Drajczyk, Member of the Management Board, Chief Investment and Technology Officer at EOS Poland.

About IFC

IFC — a member of the World Bank Group — is the largest global development institution focused on the private sector in emerging markets. We work in more than 100 countries, using our capital, expertise, and influence to create markets and opportunities in developing countries. In fiscal year 2023, IFC committed a record $43.7 billion to private companies and financial institutions in developing countries, leveraging the power of the private sector to end extreme poverty and boost shared prosperity as economies grapple with the impacts of global compounding crises. For more information, visit www.ifc.org

About EOS Group

The EOS Group is a leading technology-driven investor in receivables portfolios and an expert in the processing of outstanding receivables. With over 50 years of experience and offices in more than 20 countries, EOS offers smart services for receivables management worldwide. Its key target sectors are banking, real estate, telecommunications, utilities, and e-commerce. EOS employs more than 6,000 people and is part of Otto Group. For more information on the EOS Group, please go to: eos-solutions.com

About EOS Poland

EOS Poland is a team of experts specializing in the purchase and management of receivables. Using modern technological solutions, we provide financial services tailored to the needs of both our business partners and defaulting payers. We help to recover debts effectively, professionally and with due respect for ethical principles. We have been present on the Polish market since 1998. As a member of the Association of Financial Enterprises in Poland, we operate in accordance with the Good Practice Principles. For more information on EOS Poland, please go to: eos-poland.pl

EOS receives two Red Dot Awards

Hamburg, Germany, December 15, 2023

The EOS Group has won two Red Dot Awards 2023 in the Corporate Design and Typography categories. In spring 2022, the international financial services provider unveiled its new brand identity, which has now been honoured.

"We are thrilled to receive this award. The Red Dot Award is an incredible acknowledgement of our work," says Lara Flemming, Senior Vice President Communications & Marketing at EOS Holding GmbH. " Many of our colleagues made the relaunch possible and contributed to the successful transformation of our brand. This award belongs to them all."

The clear and dynamic design positions EOS at various touchpoints as a modern player in the European receivables management market. "We actively create change at EOS. With the relaunch, it was therefore crucial to show this attitude visually," says Lara Flemming.

The rollout of the new brand was made possible in various workstreams with colleagues in 24 countries. EOS received support for the brand relaunch from the Hamburg-based design agency Syndicate.

The Red Dot is one of the most prestigious awards for design quality. The international jury of the Red Dot Award Brands & Communication Design only awards this seal of quality to projects that impress them with their good design quality and creative performance in various categories. Further information on the award-winning EOS design projects: www.red-dot.org/eos-holding

About the EOS Group

The EOS Group is a leading technology-driven investor in receivables portfolios and an expert in the processing of outstanding receivables. With around 50 years of experience and offices in 24 countries, EOS offers smart services for receivables management worldwide. Its key target sectors are banking, real estate, telecommunications, utilities, and e-commerce. EOS employs more than 6,000 people and is part of Otto Group. For more information on EOS Group, please go to: eos-solutions.com

EOS Group achieves top position in ESG rating

Hamburg, Germany, October 24, 2023

In the course of its successful internationalization strategy, EOS Holding GmbH, Hamburg, is reorganizing its regional responsibilities: At the beginning of the coming financial year on 1 March 2024, the German market will be merged into the new Central Europe region. In addition to Eastern and Western Europe, this will create another high-growth region with the markets of Germany, Austria, Switzerland, Slovakia, Slovenia, the Czech Republic and Hungary.

In the course of this restructuring, a number of changes have been decided in the management team of the Otto Group's financial services provider: Dr. Stephan Ohlmeyer (55), a proven financial expert and insider of the industry, will join the Group on 1 November 2023. After a four-month handover period by the current Managing Director of Germany, Andreas Kropp (56), Ohlmeyer will take over the region Central Europe. After around 20 years in various management positions at the Otto Group, Andreas Kropp will in future be taking on new tasks outside the EOS Group at his own request.

"We would like to thank Andreas Kropp for his many years of commitment to EOS in a highly developed, important market for the Group," says Petra Scharner-Wolff, Group Executive Board Member for Finance, Controlling and Human Resources at the Otto Group. "Now the task is to build up the Central Europe region. With Dr. Stephan Ohlmeyer, we have found the ideal person for this task at EOS. He has been a companion in the industry for many years. His view from the outside together with his outstanding expertise as a financial expert bring new impulses at the right time."

Dr Stephan Ohlmeyer is regarded as an internationally renowned portfolio manager. After holding positions at Goldman Sachs, Morgan Stanley, Lone Star and investment firms such as Intrum and Hoist, he wants to bring his expertise to the company for the next growth steps. "Ideal conditions were created for me to join the company: With the support of Andreas Kropp and the board colleagues from Western and Eastern Europe, I can build up the necessary internal know-how for the various markets in the coming months. Together with my international experience, we will quickly move the Central Europe region forward," says Ohlmeyer.

Further changes in the top management of the Group will also be implemented on 1 March 2024: The Managing Director of the Western Europe region, Dr. Andreas Witzig will leave the Executive Board at the end of the financial year after 17 years. The 57-year-old lawyer looks back on a career of around 20 years in leading positions in the Otto Group.

"Dr. Andreas Witzig has been able to develop the Western Europe region excellently over the past years. I would like to thank him very much for this. With Sebastian Pollmer, a great talent of the younger generation is taking over who has already become intensively acquainted with the markets", explains Petra Scharner-Wolff, Group Executive Board Member for Finance, Controlling and Human Resources of the Otto Group.

Sebastian Pollmer, Senior Vice President for the Region, will succeed as the new Managing Director of the Western Europe Region. The 39-year-old has gained outstanding expertise in the field of NPL transactions and evaluations after holding positions at Norddeutsche Landesbank and KPMG since 2016. "I am very pleased about the trust placed in me. There is still a lot of potential in the Western Europe region. From March 2024, my team and I will focus primarily on leveraging precisely this potential, especially in the area of digitalisation," he says.

"In these rapidly changing times and numerous uncertainties in the economy and politics, it is becoming increasingly important to consistently adapt as a company and to map diverse skills in the management team," Scharner-Wolff summarises. "I am convinced that with the current changes we are taking the right development step into the future, which will ensure the success of the Otto Group."

About the EOS Group

The EOS Group is a leading technology-driven investor in receivables portfolios and an expert in the processing of outstanding receivables. With around 50 years of experience and offices in 24 countries, EOS offers smart services for receivables management worldwide. Its key target sectors are banking, real estate, telecommunications, utilities, and e-commerce. EOS employs more than 6,000 people and is part of Otto Group. For more information on EOS Group, please go to: eos-solutions.com

Hamburg, Germany, October 24, 2023

In the course of its successful internationalization strategy, EOS Holding GmbH, Hamburg, is reorganizing its regional responsibilities: At the beginning of the coming financial year on 1 March 2024, the German market will be merged into the new Central Europe region. In addition to Eastern and Western Europe, this will create another high-growth region with the markets of Germany, Austria, Switzerland, Slovakia, Slovenia, the Czech Republic and Hungary.

In the course of this restructuring, a number of changes have been decided in the management team of the Otto Group's financial services provider: Dr. Stephan Ohlmeyer (55), a proven financial expert and insider of the industry, will join the Group on 1 November 2023. After a four-month handover period by the current Managing Director of Germany, Andreas Kropp (56), Ohlmeyer will take over the region Central Europe. After around 20 years in various management positions at the Otto Group, Andreas Kropp will in future be taking on new tasks outside the EOS Group at his own request.

"We would like to thank Andreas Kropp for his many years of commitment to EOS in a highly developed, important market for the Group," says Petra Scharner-Wolff, Group Executive Board Member for Finance, Controlling and Human Resources at the Otto Group. "Now the task is to build up the Central Europe region. With Dr. Stephan Ohlmeyer, we have found the ideal person for this task at EOS. He has been a companion in the industry for many years. His view from the outside together with his outstanding expertise as a financial expert bring new impulses at the right time."

Dr Stephan Ohlmeyer is regarded as an internationally renowned portfolio manager. After holding positions at Goldman Sachs, Morgan Stanley, Lone Star and investment firms such as Intrum and Hoist, he wants to bring his expertise to the company for the next growth steps. "Ideal conditions were created for me to join the company: With the support of Andreas Kropp and the board colleagues from Western and Eastern Europe, I can build up the necessary internal know-how for the various markets in the coming months. Together with my international experience, we will quickly move the Central Europe region forward," says Ohlmeyer.

Further changes in the top management of the Group will also be implemented on 1 March 2024: The Managing Director of the Western Europe region, Dr. Andreas Witzig will leave the Executive Board at the end of the financial year after 17 years. The 57-year-old lawyer looks back on a career of around 20 years in leading positions in the Otto Group.

"Dr. Andreas Witzig has been able to develop the Western Europe region excellently over the past years. I would like to thank him very much for this. With Sebastian Pollmer, a great talent of the younger generation is taking over who has already become intensively acquainted with the markets", explains Petra Scharner-Wolff, Group Executive Board Member for Finance, Controlling and Human Resources of the Otto Group.

Sebastian Pollmer, Senior Vice President for the Region, will succeed as the new Managing Director of the Western Europe Region. The 39-year-old has gained outstanding expertise in the field of NPL transactions and evaluations after holding positions at Norddeutsche Landesbank and KPMG since 2016. "I am very pleased about the trust placed in me. There is still a lot of potential in the Western Europe region. From March 2024, my team and I will focus primarily on leveraging precisely this potential, especially in the area of digitalisation," he says.

"In these rapidly changing times and numerous uncertainties in the economy and politics, it is becoming increasingly important to consistently adapt as a company and to map diverse skills in the management team," Scharner-Wolff summarises. "I am convinced that with the current changes we are taking the right development step into the future, which will ensure the success of the Otto Group."

About the EOS Group

The EOS Group is a leading technology-driven investor in receivables portfolios and an expert in the processing of outstanding receivables. With around 50 years of experience and offices in 24 countries, EOS offers smart services for receivables management worldwide. Its key target sectors are banking, real estate, telecommunications, utilities, and e-commerce. EOS employs more than 6,000 people and is part of Otto Group. For more information on EOS Group, please go to: eos-solutions.com

Hamburg, Germany, July 26, 2023

- Significant increase in investment volume in Eastern and Western Europe

- Even stronger focus on international collaboration and digitalization

- Corporate Responsibility (CR): Combined Annual and Sustainability Report based on Global Reporting Initiative (GRI) standards for first time

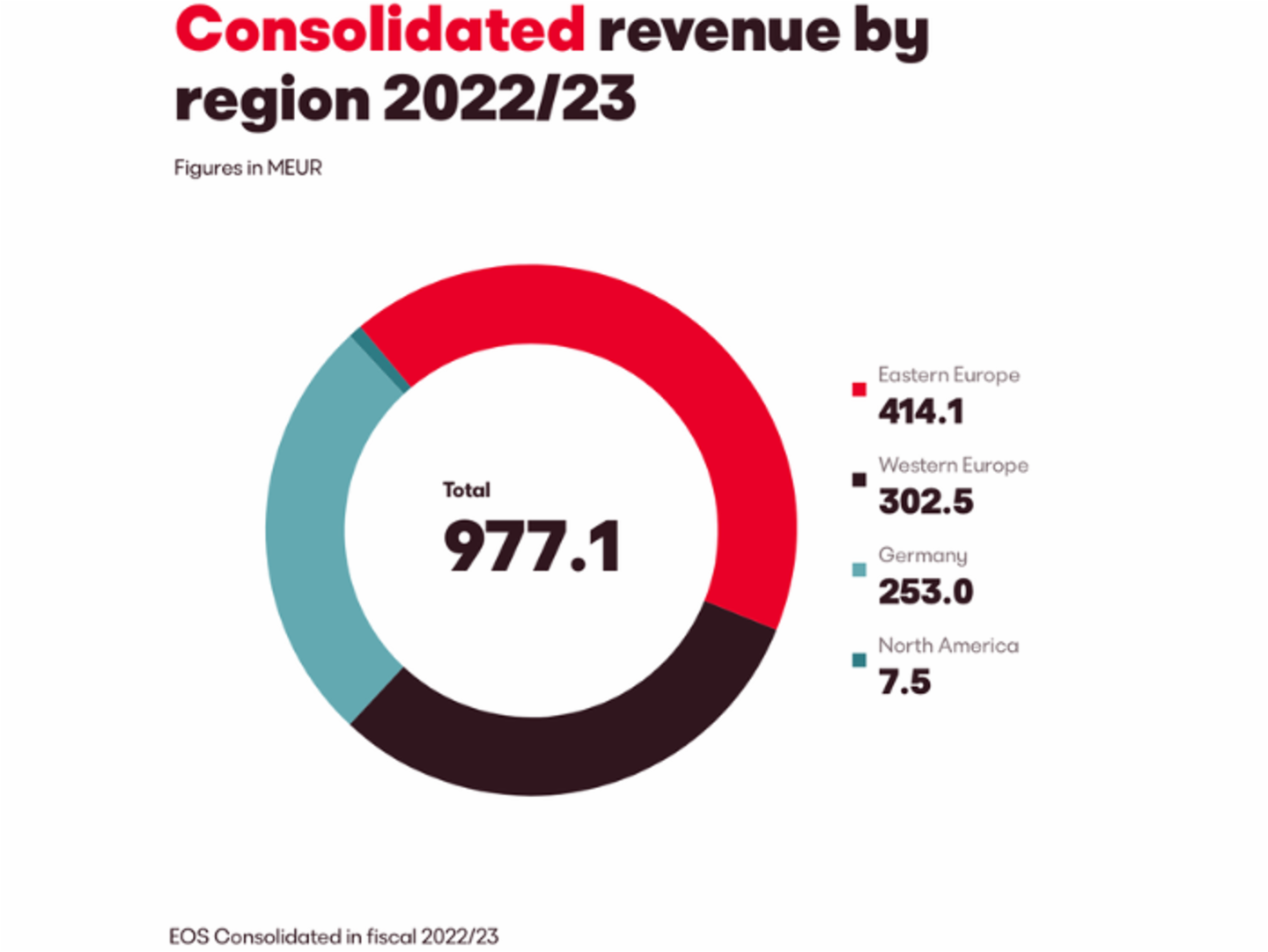

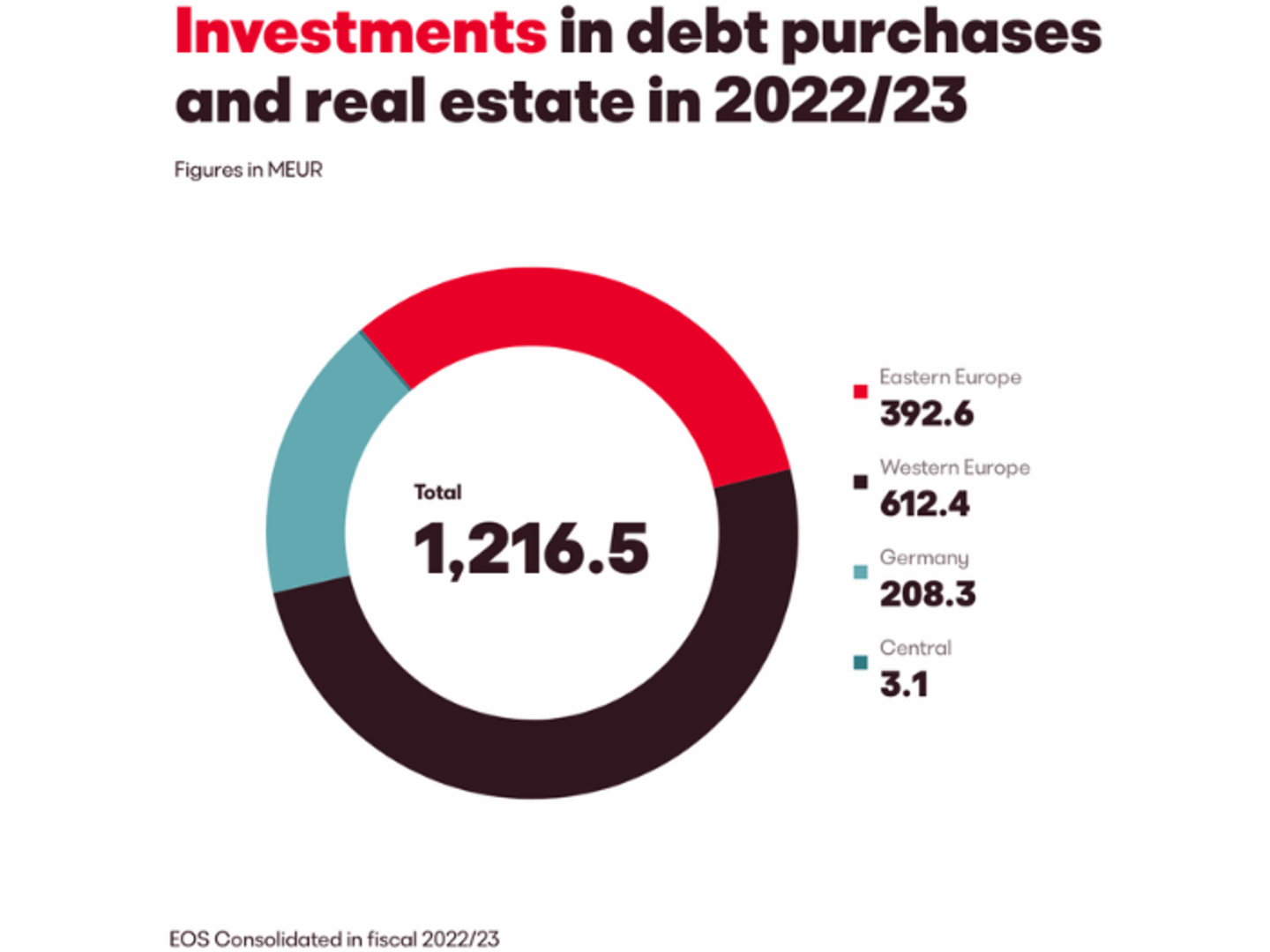

The EOS Group enjoyed strong growth in the 2022/23 financial year. Europe’s leading investor in non-performing loans, debt and real estate portfolios, and expert in the processing of outstanding receivables, achieved an EBITDA of EUR 445.9 million in fiscal 2022/23. A major factor in this success was the significant increase in investment volume of EUR 668.6 million (in the previous year) to EUR 1.2 billion, with EOS investing in both secured and unsecured receivables.

Outstanding operating performance

The expert processing of existing NPL portfolios (non-performing loans) from previous years also contributed to the increase in earnings and revenue in fiscal 2022/23. Marwin Ramcke, CEO of the EOS Group, had this to say: “Given the international political and macroeconomic situation at the beginning of the financial year, this kind of growth was not foreseeable. That we were able to achieve such a result in these turbulent times is due in particular to the dedication of our around 6,000 employees.”

The broad positioning of the EOS Group with 24 national subsidiaries in Europe has also had a positive impact on the overall result, says Justus Hecking-Veltman, CFO of the EOS Group. “Our diversification gives us enormous stability as a group of companies. We are not dependent on individual markets. Our longstanding expertise as a purchaser of NPL portfolios, but also our patience in certain markets, have paid dividends in this financial year,” says Hecking-Veltman.

Eastern Europe builds on previous year with high investment level

With a share of 42 percent, Eastern Europe is the strongest performing region within the EOS Consolidated. Compared with the previous year, the Eastern European subsidiaries were even able to increase their revenue by around 50 percent. “With an investment volume of around EUR 400 million, we were also able to build on our high figures from the year before,” says Carsten Tidow, the member of the Board responsible for Eastern Europe. This is exemplified not just by the renewed high investments in Greece, Poland and Croatia, but also by a small country like Bosnia and Herzegovina, where the secured NPL portfolio business was heavily expanded.

Western Europe quadruples investment volume

At EUR 612 million, the EOS Consolidated managed to more than quadruple its investment volume in Western Europe. This is attributable above all to the markets in France and Spain, says Dr. Andreas Witzig, member of the Board with responsibility for Western Europe. In this conjunction, Portugal is also of particular note: “Although our company there was only founded in 2022, today more than 20 colleagues are active in the Portuguese NPL market and have been able to complete their first NPL purchases.” The implementation of Kollecto+, the Group’s own debt collection software, which is already in use in eight EOS countries and creates relevant synergies, also contributed to the company’s good start.

High competitive pressures in Germany

In the German market, the EOS Consolidated recorded a decline in revenue. The main reason for this was the intense competition, says Andreas Kropp, Managing Director EOS Germany. “The German NPL market is the most established of all NPL markets we operate in as a Group. There are a lot of competitors on the market that ensure a high price level for the debt portfolios. Being connected to our own debt collection system Kollecto+ is an important step for us, allowing us to become more efficient and improve our competitiveness,” Kropp continues.

“Debt collection means taking responsibility”

For the first time, the EOS Group has published a combined annual report and sustainability report. It is based on the standards of the Global Reporting Initiative (GRI) and shows how EOS supports the UN’s sustainability goals.

“We have always said that debt collection means taking responsibility, so corporate responsibility has therefore long since been a major issue for us,” stresses CEO Marwin Ramcke. “We strive to become a little better every day. In this context, the GRI standards help us to make transparent how sustainable our actions are and what we are achieving in this area.” According to Andreas Kropp, this is not just a matter of traditional environmental issues. The fair treatment of defaulting consumers also plays a major role. “We want to help them become debt-free as quickly as possible. To this end we offer various services that allow people to pay anonymously at any time. In our German service portal, consumers can also set their own installment rates.”

About the EOS Group

The EOS Group is a leading technology-driven investor in receivables portfolios and an expert in the processing of outstanding receivables. With around 50 years of experience and offices in 24 countries, EOS offers smart services for receivables management worldwide. Its key target sectors are banking, real estate, telecommunications, utilities, and e-commerce. EOS employs more than 6,000 people and is part of Otto Group.

For more information on the EOS Group, please go to: eos-solutions.com

Hamburg, March 15, 2023

The Hanseatic Higher Regional Court (OLG) of Hamburg today upheld an action brought by the Federal Association of German Consumer Organizations against EOS Investment GmbH. According to the decision, the company must not require defaulting consumers to reimburse the collection fee, because despite engaging EOS Deutscher Inkasso-Dienst GmbH it has not suffered any reimbursable loss. EOS regards the decision as wrong and will appeal to the Federal Court of Justice. The judgment is not final.

“In our view, the Higher Regional Court of Hamburg has disregarded essential points in the proceedings,” explains Dr. Hendrik Aßmus, Head of Legal at EOS in Germany. “In all test cases addressed, there was indisputably a payment default. Costs are incurred during the processing of these receivables that are to be borne by the defaulting payer according to our understanding of the law. Ultimately, the defaulting payer has not met their obligation to pay the receivable in due time. The judgment therefore violates significant fundamental principles of German tort law, which is why we are having it reviewed by the Federal Court of Justice (BGH).”

A ruling by the Federal Court of Justice is not expected until 2024 at the earliest.

About the EOS Group

The EOS Group is a leading technology-driven investor in receivables portfolios and an expert in the processing of outstanding receivables. With over 45 years of experience, EOS offers customers in 24 countries around the world smart services for all their receivables management needs. Its key target sectors are banking, real estate, telecommunications, utilities and e-commerce. EOS employs more than 6,000 people and is part of Otto Group.

For more information on EOS Group, please go to: eos-solutions.com

Hamburg, Germany, June 7, 2023

- EOS receives the German Award for Sustainability Projects in recognition of the non-profit finlit foundation

- Jury won over by the educational concept for handling money and debt

- The financial education initiative “ManoMoneta” is already being implemented at elementary schools

The EOS Group has received the German Award for Sustainability Projects in recognition of the finlit foundation – a non-profit corporation. In the “Non-profit initiative” category, the jury acknowledged the commitment demonstrated by the foundation in helping to prevent excessive personal debt by teaching financial skills.

“It is important to talk about money, finances, and debt, but even more important to improve financial education, which is why we have established the non-profit finlit foundation. The German Award for Sustainability Projects confirms that our commitment is paying off and we are on the right track,” says Marwin Ramcke, CEO of the EOS Group.

The finlit foundation, which was launched on the initiative of EOS employees, has been campaigning for better financial education in everyday life, and opposing excessive personal debt, since 2019. “Our aim is to help people to help themselves as early as possible, which is why we start in elementary school. Reading, writing, and arithmetic are undisputed life skills – and handling money should also count as such,” summarizes Sebastian Richter, Managing Director of finlit.

The finlit foundation has reached out to almost 100,000 children in grades 3 to 6 with its first financial education initiative ManoMeta, the contents of which are consciously addressed at pupils. “We need to be aware of the world in which young people operate, and link money and finances to things that interest them, such as social media or games. “We have tailored the contents of our initiative to strongly reflect the everyday lives of children,” says Richter.

The teaching materials, which can be ordered or downloaded by interested teachers free of charge (www.manomoneta.de), impart financial knowledge on the basis of six everyday topics – Media, Consumption, Work, Household, Global Finance, and Living, and are essentially geared toward child participation. Questions such as “How much does a pet cost?” or analyzing the tasks involved in breaking down the monthly budget allow the subject of money to be addressed using modern teaching methods. In addition to analog elements, the program also includes a digital learning platform.

The finlit foundation is already starting to roll out ManoMoneta on an international scale; following the launch of the initiative in the Czech Republic last year, Slovakia, Slovenia, and Spain are now set to follow suit this year.

The German Award for Sustainability Projects 2023 was presented on June 6 in Berlin by the German Institute for Service Quality, the ntv news channel, and the DUP UNTERNEHMER magazine. The patron of the award is former Federal Minister, Brigitte Zypries. The aim of the award is to make sustainable commitment visible across various industries and levels, and, in doing so, to inspire other companies and institutions to launch their own sustainable projects.

About the finlit foundation

The finlit foundation GmbH is part of the EOS Group and was established in November 2019 on the initiative of employees. The aim of the non-profit corporation is to contribute toward financial education and thereby prevent excessive debt by engaging in social responsibility. The finlit foundation is largely financed by the EOS Group. For more information on the finlit foundation, please go to: www.finlit.foundation

About the EOS Group

The EOS Group is a leading technology-driven investor in receivables portfolios and an expert in the processing of outstanding receivables. With over 45 years of experience, EOS offers customers in 24 countries around the world smart services for all their receivables management needs. Its key target sectors are banking, real estate, telecommunications, utilities and e-commerce. EOS employs more than 6,000 people and is part of Otto Group. For more information on EOS Group, please go to: eos-solutions.com

Hamburg, Germany, March 15, 2023

- Young people in Europe are using cash more frequently than even six months ago

- When it comes to their financial future, they are especially concerned about inflation and energy prices

According to a recent survey by the international financial services provider EOS, young adults between the ages of 18 and 34 have a strong interest in finance. One observation that is particularly striking here is that nearly half of those surveyed (48 percent) have used cash more often in the last six months. In Germany the figure was 45 percent. This could be motivated by the desire to keep a tighter handle on personal finances and thus incur less debt, and is supported by current savings trends such as “cash stuffing”, where the monthly budget is withdrawn in cash and distributed across individual savings and expenditure items. A total of 7,700 consumers across 13 European countries were surveyed for the study in February.

The consequences of inflation are the greatest concern for the future

The 18–34-year-olds surveyed in Europe listed inflation (70 percent) and high energy prices (46 percent) as the main reasons for their financial worries about the future. Fear of unemployment (27 percent) also plays a role.

Young people in Germany also listed inflation (66 percent) and high energy prices (54 percent) as the main reasons for worrying about their financial future. Concerns about the inability to afford major purchases were ranked in third place (28 percent). 18 percent of German 18–34-year-olds cited the fear of unemployment as another reason for financial worries about the future.

At the same time, more than half of young Europeans (51 percent), would like a better financial education. In Eastern European countries such as Romania (70 percent), North Macedonia (54 percent), and Hungary (53 percent), where consumers took on new debt most often in the last six months, the demand for financial education is particularly high. However, respondents in the Czech Republic (50 percent) and – in Western Europe – Spain (49 percent) would also like more financial education. In Germany this figure is 32 percent.

finlit foundation provides financial education from primary school age

Jana Titov, Managing Director of the finlit foundation, knows how important it is to boost financial literacy as early as during childhood: “We take a lot of time to learn many other things like reading, writing, and arithmetic. The same should apply to handling money,” she affirms. With the ManoMoneta education program, which is currently being rolled out across Europe, the non-profit subsidiary of the EOS Group is already targeting schoolchildren as young as 9 to 13 years of age. A follow-on initiative for young people aged 13 to 17 in Germany is already at the launch stage.

About the EOS survey “Europeans in financial trouble? EOS Consumer Study”

In partnership with Dynata, a specialist in online surveys, EOS conducted an online poll of 7,700 consumers in 13 European countries between February 3–9, 2023. The survey focused on the question of how the last six months had affected the consumption patterns and financial situation of the participants.

About the EOS Group

The EOS Group is a leading technology-driven investor in receivables portfolios and an expert in the processing of outstanding receivables. With over 45 years of experience, EOS offers some 20,000 customers in 24 countries around the world smart services for all their receivables management needs. Its key target sectors are banking, real estate, telecommunications, utilities and e-commerce. EOS employs more than 6,000 people and is part of Otto Group.

For more information on EOS Group, please go to: eos-solutions.com

Hamburg, November 30, 2022

- Majority of European companies see sustainability as a trend in receivables management

- Sustainability strategy a criterion for awarding contracts to business partners

For companies, sustainability is becoming increasingly relevant. A good half (51 percent) of European financial executives think that sustainable practices will be one of the key trends in receivables management in the next two years. At the same time, by their own admission, only 31 percent of European firms are currently implementing sustainable practices in this area. In Germany it is even fewer, at 29 percent. These were some of the insights from the representative EOS Survey “European Payment Practices” 2022, which polled 3,200 companies in 16 European countries.

Sustainability is about more than just conventional environmental protection

Two out of three companies in Europe confirm that they generally assume social and ecological responsibility. However, sustainability is often reduced to issues of climate and environmental protection only. According to the survey, only 46 percent of European companies associate a solution-driven approach to defaulting consumers with sustainable practices. In Germany the proportion is 44 percent.

“Most companies have long since recognized that sustainability is a success factor for their future development. At the same time, the receivables management sector is only gradually coming to realize that a fair and individualized approach to defaulting consumers is crucial,” explains Julius Reuting, EOS Group expert in corporate responsibility (CR). “Moreover, we are finding that when customers are awarding debt collection contracts, they are increasingly looking at whether the service provider exercises social responsibility and has a good reputation.”

Sustainability strategy a decisive criterion for awarding contracts

Half of the European companies polled stated that they took the sustainability strategies of potential business partners into account when deciding to award a contract. This is also the case in Germany, where 52 percent of companies check the sustainability strategies of potential partners before they decide to work with them. In addition, 77 percent of respondents are basically in favor of companies being more sustainable.

About the EOS Survey “European Payment Practices”

In partnership with independent market research institute Kantar, EOS conducted phone interviews with 3,200 companies in 16 European countries between March 4 and April 19, 2022, to ask them about the prevailing payment practices in their respective locations. In the spring of 2022, 200 companies (each with an annual turnover of more than EUR 5 million) in each of the countries Belgium, Bulgaria, the Czech Republic, Croatia, Denmark, France, Germany, Greece, Hungary, Poland, Romania, Slovakia, Slovenia, Spain, Switzerland, and the UK answered questions about their own payment experiences and current issues relating to risk and receivables management. This is the 13th time that EOS has conducted the survey.

About the EOS Group

The EOS Group is a leading technology-driven investor in receivables portfolios and an expert in the processing of outstanding receivables. With over 45 years of experience, EOS offers some 20,000 customers in 25 countries around the world smart services for all their receivables management needs. Its key target sectors are banking, real estate, telecommunications, utilities and e-commerce. EOS employs more than 6,000 people and is part of Otto Group.

For more information on EOS Group, please go to: eos-solutions.com

Hamburg, Germany, November 16, 2022

- Full potential of AI in receivables management barely being exploited

- Less than half of German companies are (highly) data-driven

The use of data in reminder processes is standard practice at just half (52 percent) of European companies. Even among German financial executives, only 49 percent stated that their companies were (highly) data-driven compared to their competitors. These were some of the insights from the representative EOS survey “European Payment Practices”, which polled 3,200 companies in 16 European countries.

Progressive data protection let down by poor data quality

German and other European companies do not regard data protection and information security as obstacles to the successful implementation of a data strategy. Three quarters of all companies (75 percent) in Germany see themselves as (very) progressive when it comes to information security (as many as 82 percent in respect of data protection). However, companies see a need for action in relation to data volume and quality. Just over half (53 percent) rate their own data volumes as progressive, while just 49 percent feel the same about their data quality. To be able to compete in the long term, companies in Germany need the resolve to implement a data strategy, urges Jakob Spitzer, Director Analytics at EOS. In this context, the effort and investment in the expanded use of data are worthwhile. “Greater transparency and efficiency and the most extensive automation of business processes possible help companies to survive in a digital world.”

The trend towards extending data-driven business processes is positive. More than a third (37 percent) of companies in Europe would also like to use data in future for their receivables management decision-making. In Germany, as many as 40 percent of the companies polled stated that they wanted to continue to expand this area of application. “Intelligent use of data offers major advantages, for example, when it comes to approaching defaulting customers,” explains Spitzer. “For instance, historical data can be used to help make decisions about which communication measure, channel and tone have the greatest likelihood of resulting in payment.”

Artificial intelligence offers potential for receivables management

The use of artificial intelligence (AI) in particular is becoming increasingly important for a successful data strategy. 32 percent of companies in Europe stated that thanks to self-learning algorithms, AI was already improving dunning procedures at their companies. Another 31 percent are using AI for the initial steps in the receivables management process. A similar picture emerges in Germany, where the percentage of companies reporting this development was 27 and 33 percent respectively.

Nevertheless, there is no consensus among European companies overall about the usefulness of AI. Whereas 44 percent believe that AI will revolutionize receivables management, 30 percent believe it is not very important. “However, our findings show that data and the use of AI make receivables management even more efficient,” explains Jakob Spitzer. “By analyzing what has happened in the past we can make reliable predictions for the future. At EOS, for example, we generate a range of possible payment plans for settling an outstanding debt. Subsequently, a data-driven algorithm evaluates the probability of success,” adds Spitzer. “Ultimately, only the installment plan most likely to succeed is suggested to the consumer.”

About the EOS Survey “European Payment Practices”

In partnership with independent market research institute Kantar, EOS conducted phone interviews with 3,200 companies in 16 European countries between March 4 and April 19, 2022, to ask them about the prevailing payment practices in their respective locations. In the spring of 2022, 200 companies (each with an annual turnover of more than EUR 5 million) in each of the countries Belgium, Bulgaria, the Czech Republic, Croatia, Denmark, France, Germany, Greece, Hungary, Poland, Romania, Slovakia, Slovenia, Spain, Switzerland, and the UK answered questions about their own payment experiences and current issues relating to risk and receivables management. This is the 13th time that EOS has conducted the survey.

Further information on the EOS study "European Payment Practices"

About the EOS Group

The EOS Group is a leading technology-driven investor in receivables portfolios and an expert in the processing of outstanding receivables. With over 45 years of experience, EOS offers some 20,000 customers in 25 countries around the world smart services for all their receivables management needs. Its key target sectors are banking, real estate, telecommunications, utilities and e-commerce. EOS employs more than 6,000 people and is part of Otto Group.

For more information on EOS Group, please go to: eos-solutions.com

Press Contact EOS in Austria